Not too long ago I was carrying a substantial amount of credit cards and justifying the annual fee to myself with all of the benefits. However, I decided that trying to get out of debt was a greater priority so I started to one by one “require” my cards to have a return on investment of the annual fees and ended up dumping most of them.

The five cards I have left are the American Express Delta Platinum Card, the American Express Hilton card, the American Express Delta Business Card, and two American Airlines cards. Here are how each of them performed in 2015 along with my decision to keep them or cancel them.

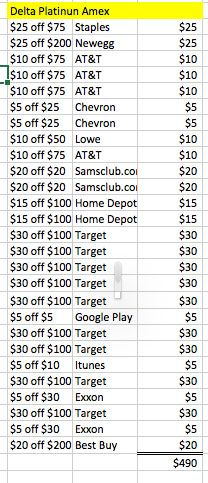

1. The American Express Delta Platinum Card – $195 annual fee, free annual domestic companion certificate, free checked bags are some of the main benefits.

2015 was a stellar year for American Express offers. I only participated in offers where there was an immediate benefit – for example, the ability to purchase gift cards for gas, or Visa gift cards, or some other immediate quick turn around. I have only two users on this account. I loved the $30 off $100 at Target or Walmart that was able to be used 5 times per account. I also had multiple gas offers, and I purchased Shell gas cards at Best Buy to qualify for that bonus.

$490 in statement credits for a $195 annual fee and a companion certificate – add to the fact that I’m in a Delta hub and the American Express Platinum card which I’ve had since 2001 survives another year.

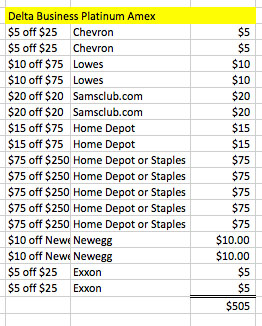

2. The American Express Delta Business card. – $195 annual fee, free annual domestic companion certificate, free checked bags are some of the main benefits.

I originally applied for this in 2013 when American Express was offering 5,000 MQMs with first purchase and 15,000 MQMs after $5,000 in purchases within 3 months. I planned on cancelling it in 2014, but was given a retention offer of 25,000 Skymiles to keep it.

The major American Express offers for the Business card were $75 off $250 at Home Depot or Staples that you could redeem five times per account. Total savings of $505 for the year. This one will be kept as well put there haven’t been a whole lot of lucrative offers lately – this one may be in danger.

3. American Express Hilton card – no annual fee. I have 5 cardholders on this account to maximize the American Express offers. Given that there is no annual fee, obviously this is one that I’m keeping. I keep these cards in hibernation until an offer arises and then I carry them with me to redeem.

$455 in savings for no annual fee makes this a solid choice. I’ve also set up separate Twitter accounts for each card in order to use the hashtags to load offers to the cards quickly and easily.

4. The two American Airlines cards – each $95 annual fee.

I can’t get rid of these even though I try ever year. Retentions always gives me a “spend X – receive a one time statement credit equal to the annual fee”. They’re great to extend the expiration of my American Airlines miles but I’ve tried on each card to cancel but basically keep it each year because the annual fee is offset. Perhaps someday they’ll realize this will never be my main card in my wallet, until then it’s great when I use my Avios to fly to California and get free checked bags because of this card.

Regarding getting out of debt – I’ve cleared off everything except for my house and only have 9 years left on my mortgage. I have a fully funded emergency fund as well and am finally socking money away in a Roth IRA for retirement. I’m glad that I used some of those annual fees to pay off debt and that each card pasts the test of returning on investment of the annual fee.

How do you get targeted for so many Amex offers? I have all those Amex cards and more, and haven’t seen all those offers – especially the multiple ones (and I do have some authorized users in various accounts).

I setup all of my authorized users on all cards on Amex Sync. Then when an offer comes I tweet out #amexexxon or whatever the offer is. 80% of the offers were Twitter based. I use tweet deck to do one tweet from all accounts